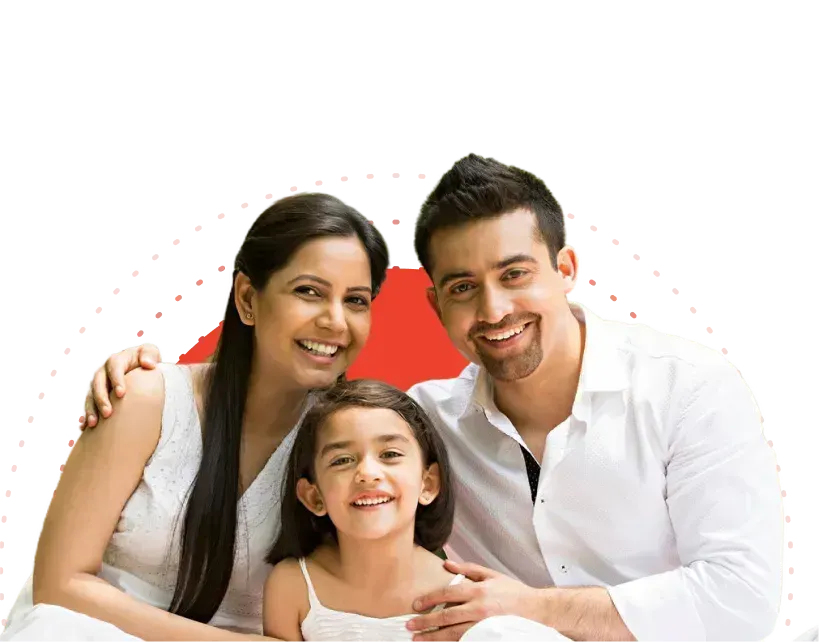

Child Plans

You've been watching your child grow, hitting milestone after milestone, and with each passing day, you're reminded of the dreams and aspirations you hold for their future. But today, just attempting to fuel those dreams into reality ends up requiring more than just emotional support and encouragement. It demands prudent financial planning, especially with education costs rising faster than ever and career paths becoming increasingly diverse and demanding. If not already, you should consider getting a decent child insurance plan right about now if you are planning to have kids or have just become a parent. The right plan can make sure your child's dreams stay protected in these inflated economic conditions.

- Ensures your child’s future stays protected even in your absence through premium waiver

- Offers payouts at key education milestones to support growing needs

- Provides flexible investment options to match your goals

- Offers tax benefits under Sections 80C and 10(10D)